About the Author/Organisation

Created by Tumasile Chilunga.

About the Project

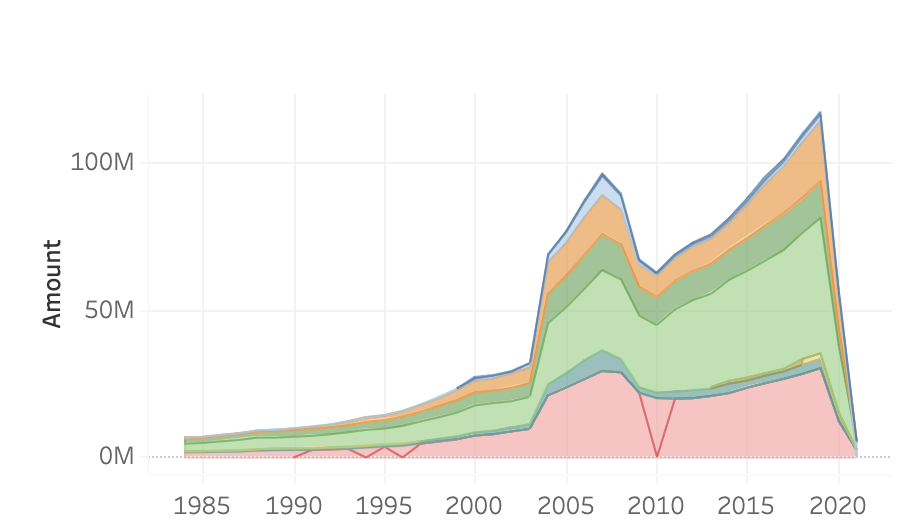

Theses dashboard contains Open Data Tax Receipts- Monthly Exchequer Tax Receipts 1984 - 2021 March The data is broken down as follows: Customs, Excise Duty, Capital Gains Tax, Capital Acquisitions Tax, Stamps, Income Tax, Corporation Tax, Value Added Tax, Training and Employment Levy, Local Property Tax, Unallocated Tax Receipts

Why it's a Showcase

It provides easy access to Irish government's tax receipt data, spanning from 1984 to March 2021. This level of transparency allows citizens to understand how the government collects revenue and how those figures have changed over time. The dashboard breaks down the data into various tax categories like Customs, Excise Duty, Income Tax, etc. This makes it easier for people to analyse specific tax sources and trends. While the current version focuses on visualisation, the open nature of the data allows users to download it and conduct their own analysis. This empowers researchers, journalists, and economists to explore the data further and potentially uncover valuable insights into Ireland's fiscal health.

Impact of the Showcase

By making tax revenue data readily available, the showcase fosters informed public discourse on government spending and economic policy. Citizens can track government revenue streams and hold them accountable for their financial decisions. The insights gleaned from the data can inform policymakers in areas like tax allocation, budgeting, and economic development strategies. This showcase serves as an example of how open data can be utilised to create valuable tools for public information and analysis. It can inspire other government agencies to make their data publicly accessible, fostering a more transparent and data-driven society.

Derilinx

Derilinx